2018 has been a big, yet bumpy, year for the U.S. energy storage market. We've seen huge increases in behind-the-meter installations in homes and businesses, but also supply bottlenecks and policy uncertainties that restrained larger-scale battery installations.

How are these trends likely to play out next year?

That’s the topic that Ravi Manghani, energy storage research director at Wood Mackenzie Power & Renewables, took up in Tuesday’s opening presentation at Greentech Media’s annual Energy Storage Summit in San Francisco. Manghani sketched out the key developments of 2018, and made five “bold and not-so-bold” predictions for what will be different in 2019.

The first is that utility-scale energy storage installations, after seeing a drop in the first three quarters of 2018 compared to last year, will pick up again next year. As Manghani noted, the front-of-meter battery market is inherently a lumpy one, with one or two massive projects dominating annual figures.

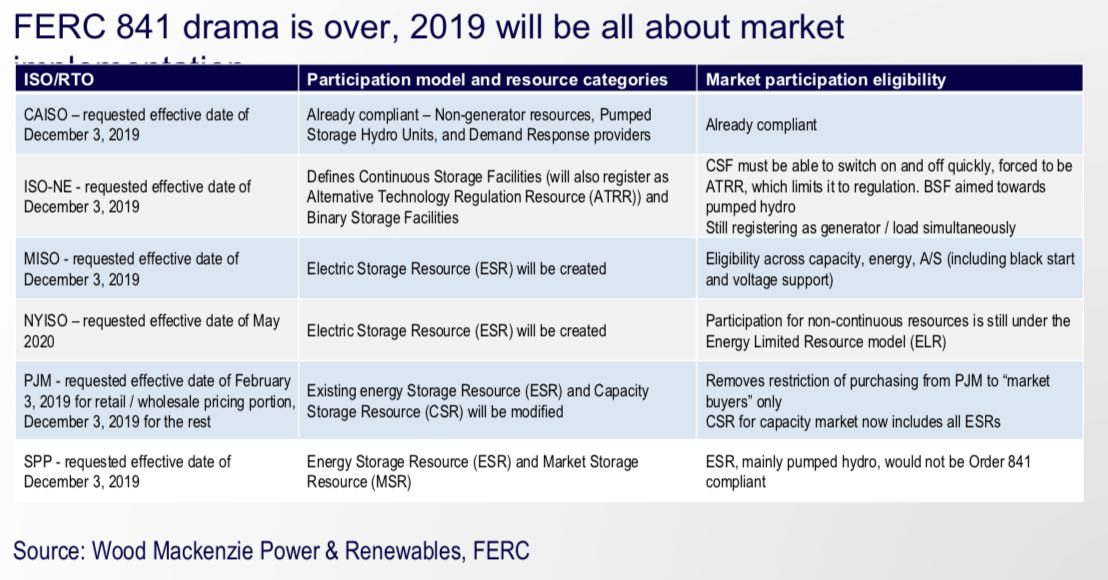

But there’s also been a policy issue holding up utility-scale storage this year, Manghani said. The uncertainty over how the nation’s grid operators are going to implement Federal Energy Regulatory Commission (FERC) Order 841, approved in February, has stalled projects. Order 841 broadly directs grid operators to create market mechanisms that accommodate batteries’ unique abilities to both charge and discharge from the grid, and ramp up and down at speeds that traditional generators can’t match. But the details of how each ISO and RTO plans to implement FERC’s requirements has been the subject of much debate in the energy industry, as we’ve noted in ongoing coverage of the various straw proposals coming out over the past few months.

With grid operators finally filing their official Order 841 compliance plans with FERC this month, the energy storage industry now has a much more complete picture of how each grid operator is planning to move forward. While the Energy Storage Association (ESA) does have complaints about these final plans, indicating there’s more debate ahead, opening up Order 841-mandated market changes this year is still expected to open a massive new set of opportunities to serve in wholesale energy and ancillary services markets.

The second prediction for 2019 is bolder than the first — the observation that the record for solar-plus-storage deployments in 2018 will be broken yet again in 2019. That’s based on the forecast for falling solar and battery prices, combined with a continuation of the federal Investment Tax Credit for solar that can include the cost of batteries as part of the installation.

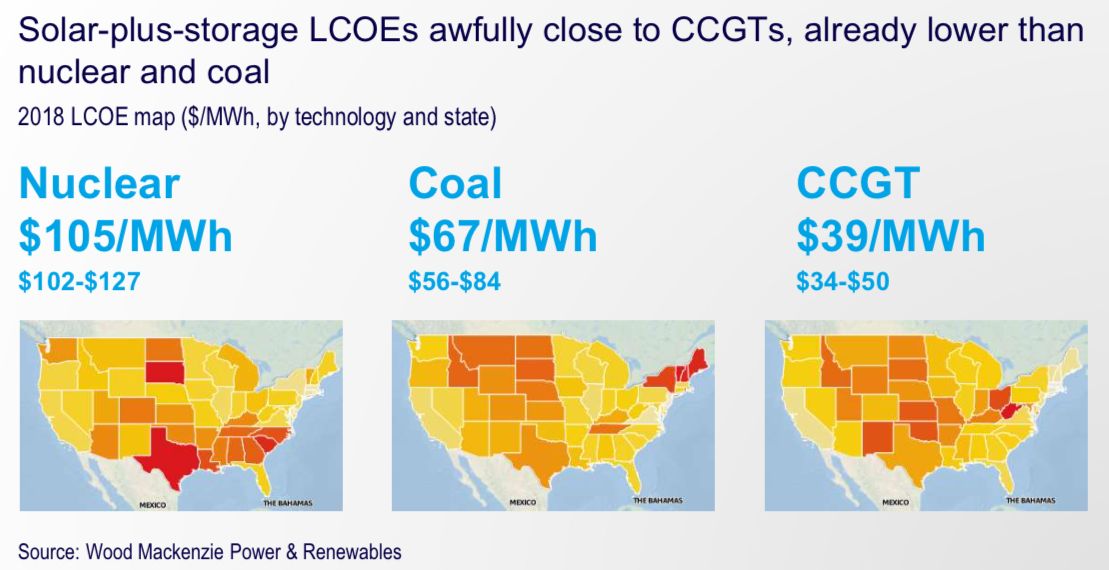

This year has already seen records broken for solar-plus-storage power-purchase agreements, Manghani said. Xcel Energy in Colorado saw bids for solar-plus storage at $36 per megawatt-hour, compared to $25 per megawatt-hour for standalone solar, and NV Energy has seen even lower bids in its solar and solar-plus-storage RFPs.

That equates to about a $6 to $7 per megawatt-hour premium for solar projects that are partially dispatchable — if not completely dispatchable in the manner of a power plant. By 2023, when the ITC window closes, the levelized cost of energy (LCOE) of combined solar-storage projects will put them in direct competition with traditional generators, Manghani said.

The push for longer-duration solar-plus-storage is also being driven by some key corporate efforts, such as Microsoft’s proxy generation PPA or Google’s 24x7 clean generation initiative for its data centers, that are trying to align their demand to their renewable energy portfolios.

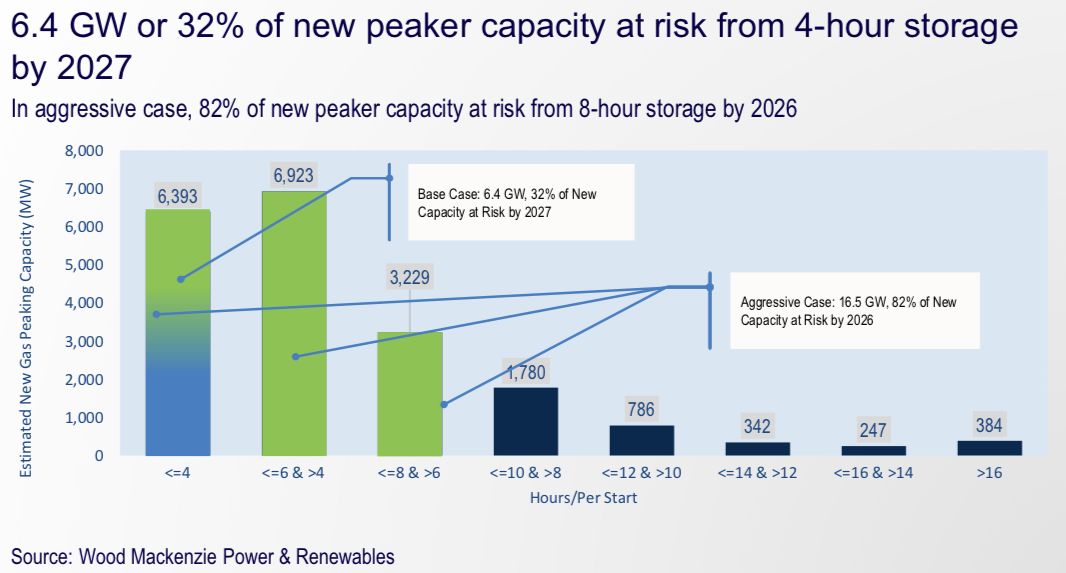

This also feeds into Manghani’s third prediction: that natural gas-fired peaker plants, already a dying breed in storage-rich markets like California, will continue to “lose favor” in 2019.

Wood Mackenzie Power & Renewables projects that up to 6.4 gigawatts of future peaker capacity, or about 32 percent of what the U.S. is projected to need by 2026, could be at risk from energy storage with durations of four hours or greater — and that’s with relatively conservative projections of 6 to 8 percent decreases in energy storage costs annually over that time.

If one takes more aggressive estimates of 10 to 12 percent declines every year through 2026, the share of new peaker plant capacity taken by batteries could rise to as much as 80 percent, he said.

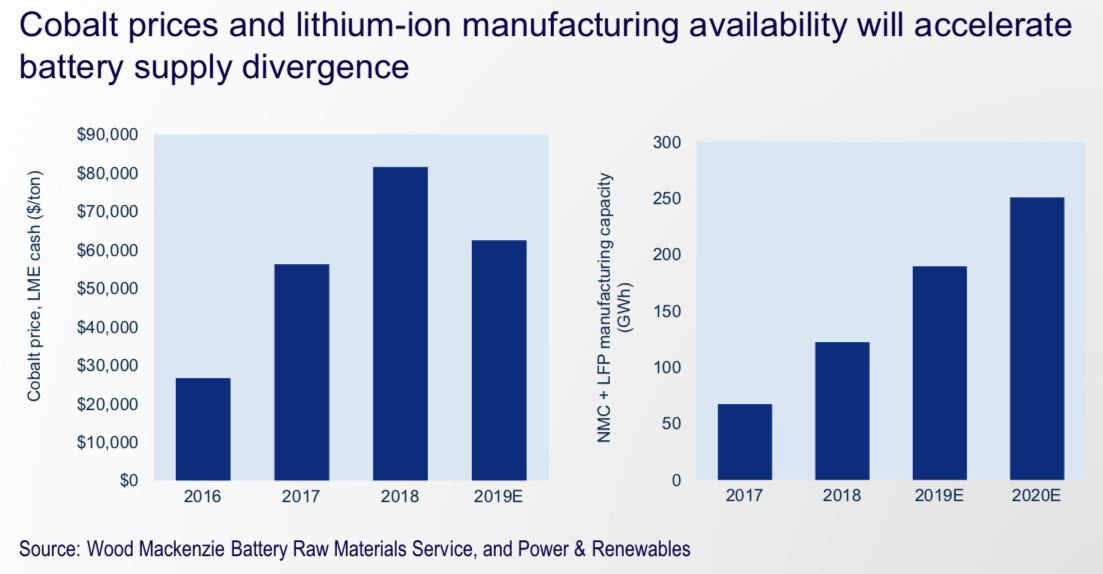

Manghani’s fourth prediction is centered on one of the industry’s roadblocks this year: the supply chain shortages that have slowed growth in the commercial and industrial behind-the-meter sector. Two key trends are driving this shortage — a temporary bottleneck in manufacturing capacity and the rising global price of cobalt, a key ingredient of many higher energy density lithium-ion battery chemistries, such as lithium nickel manganese cobalt oxide and lithium nickel cobalt aluminum oxide.

These batteries are particularly favored for the electric vehicle industry for their higher energy density. Since EVs are driving the battery market, battery manufacturing took up nearly half of global cobalt production in 2017. Consequently, cobalt prices more than doubled from 2016 to 2017.

While Wood Mackenzie predicts that cobalt prices will decline over the next two years, the current price spike has focused attention on lithium-ion chemistries that don’t require cobalt, such as lithium iron phosphate (LFP), lithium manganese oxide and lithium titanate. Manghani predicted that LFP, the most common of these chemistries, will retake its former place as the lithium-ion chemistry of choice for the energy storage industry in 2019.

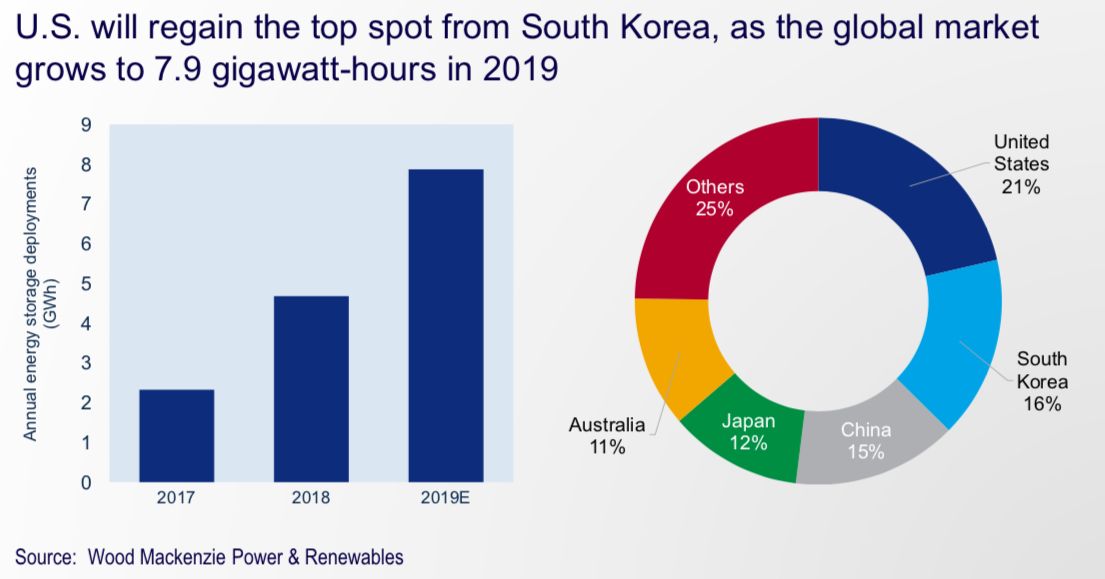

The final prediction is that the United States, which lost its place as the world's biggest storage market in 2018, will retake that position next year.

South Korea took the top spot this year with nearly 1.1 gigawatt-hours of energy storage deployed, compared to just under 700 megawatt-hours in the U.S. — a result of the Korean government’s policy to allow storage-backed wind and solar projects to earn renewable energy certificates worth five times their capacity value, which drove nearly $400 million in energy storage investments and a pipeline of projects that’s already overshot its goal of 800 megawatt-hours by 2020.

But with the start of markets being enabled by FERC Order 841, stronger growth in residential solar-storage systems, and an increasing number of state energy storage incentives and targets up and running, the U.S. is likely to regain its top position in 2019, with a projected 21 percent of global installations, followed by South Korea, China, Japan and Australia.

Missing out on all the action at our storage summit? You can watch the livestream from your chair.