Editor’s note: This article originally appeared on Global Reinsurance.

From chatbots that streamline how insurance is being sold directly to customers and fully automated claims processing via mobile apps, to monitoring driver behavior to inform eligibility for discounted policies, it’s no secret that artificial intelligence, or AI, is a disruptive technology that is here to stay, with many use cases that can be applied to the insurance industry. The ability to reduce the need for humans to be part of an external customer interaction is a major efficiency gain, but there are also a host of less spoken about, but perhaps just as impactful, ways that machine learning (a facet of AI) is now being used to find efficiency gains within property reinsurance companies. With the growth in computer learning an automation companies are looking at intent based networking as a way to make the running of networks smoother. There is still a place for human interaction with customers utilising technology, however, there are some companies that have implemented the use of the customer service chatbot similar to those by Botpress which have become increasingly popular for such use. Nevertheless, there are still those who prefer the human element, with software like help desk by Salesforce is the sort of customer service solution that businesses find to benefit customer relations… what is help desk?

Before we take a deeper look at an application of machine learning within reinsurance, let’s first examine one of the key challenges reinsurers face. Each renewal season, the CRO, executives, and underwriting teams within any organization across the industry get together to ask the same question: What changes do we need to make to boost the performance of our portfolios? To answer this, companies often begin a lengthy process of reviewing all the deals they’ve written and are considering renewing to see how they could improve the portfolio.

Therein lies the challenge: How do companies quickly assess the impact of making changes to their portfolios and determine the best alignment with their strategic goals? Which deals should they write more of, which should they write less of, and which ones are the key profit drivers to consider when putting together a renewing portfolio that is better than the prior year’s in-force book? Often this is not a quick process because they must manually optimize their portfolio each renewal season.

The Challenges in Strategic Planning and the Status Quo

Why is it so difficult to manually optimize portfolios? Mainly because the number of moving parts makes it very difficult. Finding the best trade-off between risk and return in a given set of portfolios is a time-consuming manual feat due to the magnitude of the available possibilities.

To illustrate this, imagine we have a tiny portfolio of just 10 treaties and we would like to evaluate the impact of changing the share we underwrite of each one in increments of 10% while balancing two objectives: maximizing return and minimizing 1% Value at Risk (VaR). There are 1010 combinations or 10 billion possible new portfolios that could be generated from this. If you could evaluate the risk/reward of 1,000 of these new portfolios per second it would take three months to process all of them. If we were to increase the size of our portfolio to just 15 treaties, the number of combinations is 1015, and it would now take 31,000 years to evaluate all of them!

Enter machine learning (specifically multi-objective genetic algorithms). It’s not that the machines can necessarily process all the data-they can’t-instead, they are programmed to efficiently tackle the problem through a different approach that allows them to sample selectively and learn what combinations are even feasible, quickly iterate, and re-sample. Having sampled a more manageable, but still large number of possible combinations (often on the order of hundreds of thousands or millions of potential portfolios) in a short time frame (i.e., in minutes), it becomes possible to determine the optimal share participations.

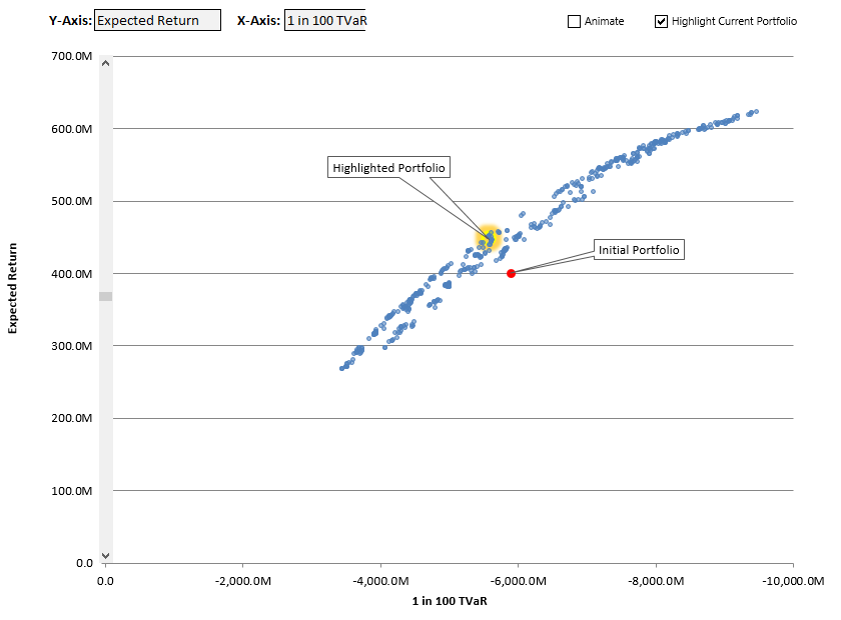

Let’s make one important point: Machine learning is not supposed to replace underwriting. Its goal here is to augment the underwriting capability by processing larger volumes of data to help figure out the best set of portfolios in a shorter amount of time. In the end, the portfolio manager still needs to choose the portfolio that fits the company’s goals and risk tolerance from the set of optimal ones that the optimizer produces (see blue dots in Figure 1).

Figure 1: A snapshot from the Analyze Re Portfolio Optimization Engine. Multi-objective portfolio optimization enables reinsurers to move their initial portfolio to a set of portfolios (The “Pareto Efficient Frontier”) that improve expected return and reduce risk. The AI/machine learning algorithm does this by churning through hundreds of thousands to millions of possible portfolio combinations in a matter of minutes and providing a set of 100 recommended portfolios that the underwriter can then select based on their risk appetite.

In our experience speaking with various global reinsurers, some can and do tackle the strategic planning challenge through approximation and even a manual approach at a higher level. But depending on the complexity of the deals at stake, this approach can still take weeks, if not months, and yet doesn’t accomplish what it sets out to, namely providing the set of optimal recommendations. Other reinsurers simply don’t optimize their portfolios-instead, they look at the deals that will bring in the most premium, do a quick gut check of the risk, and then reconcile writing more of those deals with where they have the most critical business relationships.

Machine Learning Is the New Normal for Portfolio Optimization

So how exactly does the machine work to build the efficient frontier? As a hypothetical example to demonstrate how the algorithm works, let’s say that I asked you to find the office of one of your customers, and let’s assume that you cannot Google it. What would you do?

Given that there are some 5.6 million commercial office buildings in the U.S., you wouldn’t go around knocking on every door hoping to find them. But that’s exactly how the old manual approach to portfolio optimization works.

The new approach, using machine learning, is to not to knock on every single door – instead, the approach is to use iterative resampling, so locations are sampled randomly but guided by what is learned from previous attempts. To illustrate, assume you can only ask the question, “Is customer x in your state/region/county/street?” A good first approach would be to inquire in each state and ask, “is customer x in your state?” From there, you would quickly narrow down to one state. Now you would call each region within the state and ask, “Is customer x in your region?” Note that because you have learned that customer x is in a given state, you are now asking in which region in that given state does customer x exist. Eventually, you would then be asking each city, neighborhood, street, getting closer to the actual location at each new iteration, until you find customer x’s office. This methodology of selectively sampling and dropping the populations that fall outside of what you’re looking for is effectively how machine learning works to optimize reinsurance portfolios for greater profits and risk reduction.

In portfolio optimization, only the best set of solutions gets chosen to produce the next set of even better solutions. The process is repeated iteratively to converge on what ultimately will produce the portfolio that is optimal– that is, maximizes profits and minimizes risks.

Machine Learning in Future Reinsurance Portfolio Optimization

Machine learning is not a new concept. When we first started to see it getting applied in the industry to portfolio optimization of reinsurance, we saw what is known as a linear optimization method, whereby the machine would first tackle the task “maximize profit,” for example. Then it would move on to tackle the task “minimize VaR,” then “minimize TVaR.” The popularity of this approach was based mainly on lesser computing capability. Today, this sort of optimization is becoming obsolete and is effectively being replaced by what is known as multi-objective, multi-constraint optimization. This latest approach is much more effective in the recommendations it can provide, enabling the machine to simultaneously tackle the three tasks, as well as more customized company departmental constraints, such as “ensure combined ratios stay below 95%” and “lock or do not touch deals x, y, and z.”

In the future, perhaps the Chief Risk Officer or Chief Underwriting Officer will be able to simply ask an AI/machine learning-based chatbot, “Show me how I can increase profits by 10% by minimizing my 0.4% TVaR, but make sure that less than 30% of my hurricane risk is in Florida,” and the machine will go to work and shortly afterward be able to respond “Done.” This is not science fiction; all the components exist today. But as with autonomous vehicles, there is still a lot of work to be done to self driving car technology before we can completely delegate control to a machine. However, this much is clear: While today’s reinsurance market may be soft, there are more profits to be had and underwriters are increasingly relying on machines to do the legwork to find them. It is important to use every practical means at our disposal to adapt our analytical capability, or risk falling behind.

So, whatever the market state is, we’ve found that machine learning–assisted portfolio optimization consistently provides significant value to an underwriting team when evaluating how portfolios react to both macro and micro changes. This in turn can facilitate better understanding around the outcomes of making any changes and thus help dramatically improve strategic decision-making.

How does your organization approach portfolio optimization? Send a note to info@analyzere.com or chat with us by tweeting @analyzere.