Corporate procurement of solar is on the rise for both distributed generation and offsite utility PV.

As a testament to that trend, Apple hit its 100 percent renewable energy target this week, Google achieved its 100 percent renewable energy goal earlier in the month, and Microsoft recently set a new solar procurement record. At the same time, smaller companies from Taylor Farms to Kingspan, a building materials firm, are choosing to put solar at the center of their corporate sustainability strategy.

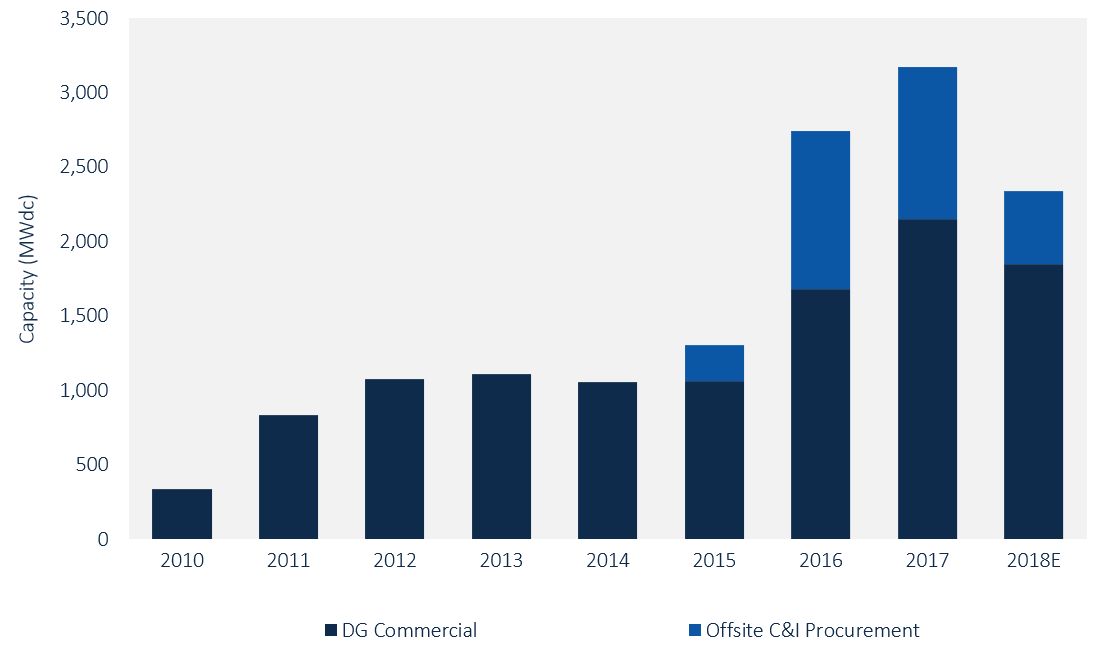

In the U.S. there is currently a combined 11.6 gigawatts of offsite, front-of-the-meter projects and distributed, behind-the-meter projects with commercial or corporate offtakers. There has been more than 1 gigawatt of distributed (DG) solar installations annually since 2012, reaching over 2 gigawatts in 2017.

Utility PV has seen two consecutive years with over 1 gigawatt of capacity additions. While corporate and commercial customers are procuring more solar each year, each of these segments has unique drivers of growth.

Annual U.S. Corporate Offsite and DG Solar Installations (MWdc)

Source: GTM Research U.S.Distributed Solar Service

Looking ahead, corporate solar procurement is forecast to slump in 2018 as the market readjusts. For both distributed generation and offsite solar, 2016 and 2017 were massive years because of the anticipated expiration of the federal Investment Tax Credit. As a result, project pipelines filled up and were then built out over these two years.

Additionally, uncertainty about the Section 201 tariffs caused companies to hold off on procurement in the later half of 2017, which exacerbated the slowdown in 2018 installations. However, GTM Research expects the combination of distributed generation projects and offsite, utility deals this year to cause an increase in 2019 total capacity additions.

Virtual PPAs drive the bulk of offsite C&I procurement

Corporate procurement of offsite C&I solar has been growing rapidly since 2015. To date, there are 31 projects operating and 21 in development. The first 245 megawatts of offsite C&I solar projects came online in 2015 and were driven by three primary mechanisms: direct access, physical/virtual PPAs, and green tariffs.

While California’s Direct Access program (DA) allowed commercial entities to procure renewable energy for many years, it has driven only 18 percent of offsite C&I projects to date. With the DA load capped, the program is unlikely to drive additional utility PV development.

Physical/virtual PPAs are the largest driver of offsite C&I projects, accounting for 64 percent of capacity currently operating and 61 percent of capacity in development. Without adequate offerings from their local utilities, many corporations have signed physical PPAs, delivering energy directly to the buyer, or virtual PPAs, where the corporate buyer enters into a financial arrangement that does not require power to be delivered directly.

To date, green tariffs have driven 18 percent of operating projects. Some of the first corporate offtake agreements, like the Switch Station project for Switch in Nevada, were the result of negotiations between the developer, local utility, and corporate offtaker and were the precursors to green tariff programs.

While many utilities are exploring how to form their own green tariff programs, many existing green tariff programs offer renewable energy at a premium or at par with wholesale generation — and this isn’t sufficiently attractive to corporate buyers.

Green tariffs have the potential to be the largest driver of offsite C&I solar; however, physical/virtual PPAs through ERCOT, PJM and other territories can often offer better savings to corporations. Consequently, physical/virtual PPAs are likely to remain the primary driver of new projects for the next several years until utilities offer green tariff rates that provide sufficient savings.

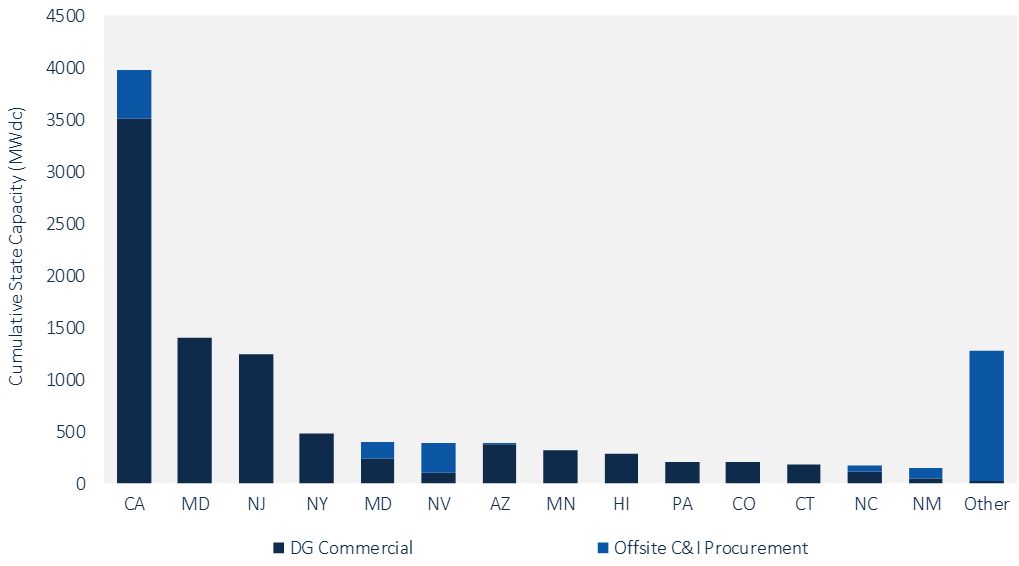

Corporate Offsite and DG Solar Installations by State (MWdc)

Source: GTM Research U.S.Distributed Solar Service

DG solar is increasingly third-party owned

When it comes to DG solar, annual installations have been growing substantially for the past few years. This has mostly been driven by significant demand pull-in for major commercial state markets like California, Massachusetts and New York. In these states, imminent policy deadlines such as SREC qualification in Massachusetts or new time-of-use rates in California caused a surge of development activity in 2015-2017.

As DG commercial solar has grown, so has third-party ownership. Today, customers prefer to sign PPAs rather than to own their DG systems outright. Third-party ownership in the DG solar segment has been increasing steadily from 39 percent in 2015 to roughly 53 percent in 2017.

There are several important drivers of this trend.

- Commercial solar is diversifying: Commercial and industrial customers still make up the largest portion of the market, but community solar is growing rapidly, as are public-sector customers such as schools and government entities.

- Incremental improvements in financing for commercial DG: As the market has matured, better financing options have become available for small and medium-sized commercial projects. The majority of commercial solar is still made up of large (>1 megawatt) projects or portfolios of projects that optimize economies of scale and distribute the fixed transaction costs over the largest possible deal size. But investors are slowly getting more comfortable with financing solar, and as returns in the utility-scale and residential sectors have compressed, commercial is becoming an increasingly attractive space.

- Increasing market complexity: As mentioned previously, several major commercial markets have grown in complexity in the last few years. Massachusetts is transitioning to the SMART program, California is implementing new time-of-use rates, and New York is determining the new DER compensation rates for distributed solar projects. Commercial customers are business owners — they would rather sign a PPA and have an expert deal with the complex changes in these markets than navigate the policy and market changes themselves.

No two commercial customers are the same, but as these trends continue, we expect customers will continue to prefer third-party ownership for distributed solar projects. We’ll be publishing a detailed forecast of our view in an upcoming report on commercial solar consumer finance trends.

***

GTM Research Senior Solar Analysts Michelle Davis and Colin Smith will be speaking at SEIA’s Solar Goes Corporate event in Boston on April 27. To learn more about these and other trends impacting corporate solar procurement, be sure to attend. See the agenda and register here.

Want access to all of GTM Research's commercial solar data and analysis? Learn more about our U.S. Distributed Solar Service here.