Get in touch

-

Sonia KerrSonia.kerr@woodmac.com

+44 330 174 7267 -

Kevin Baxterkevin.baxter@woodmac.com

+44 408 809922 -

Vivien LebbonVivien.lebbon@woodmac.com

+44 330 174 7486 -

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Global storage market to grow from 12 GWh to 158 GWh by 2024

Energy storage will become a key power grid asset

1 minute read

The global energy storage market will expand 13-fold by 2024, according to new research from Wood Mackenzie Power & Renewables.

According to the report, ‘Global energy storage outlook 2019: 2018 year-in-review and outlook to 2024’, energy storage has been creeping into decarbonising markets over the past 5 years.

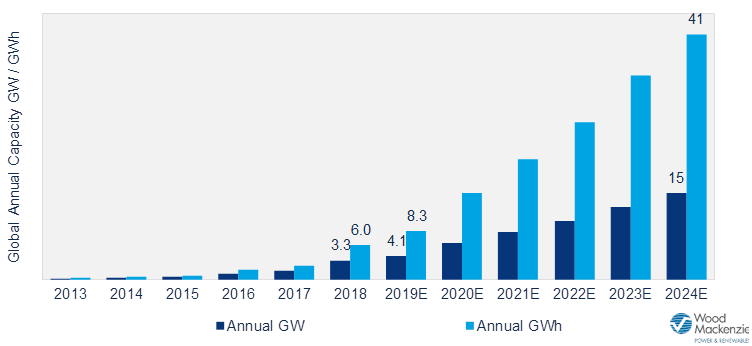

Commenting on the report, Ravi Manghani, Wood Mackenzie Power & Renewables Research Director, said: “From 2013 to 2018, we saw fledgling market growth. This was reflected in a global GWh compound annual growth rate (CAGR) of 74%, although we did observe relatively small deployment totals of 7GW/12GWh for the period.

“Nevertheless, these developments have shifted the minds of global regulators, policy makers, grid operators, asset operators and developers, in terms of how energy systems can be balanced. Market structures have generally struggled to keep up with the pace of this technology, illustrated by the limited number of revenue streams available to appropriately compensate storage. More than half of the GWh during this period came online in 2018 alone, beckoning an inflection in storage demand.”

2018 was a record-breaking year

As noted in the Wood Mackenzie Power & Renewables report, 2018 saw 140% YoY growth in GWh terms – with a total of 3.3 GW/6GWh deployed globally.

“Half of this GW capacity was front-of-the meter (FTM), driven by accessible ancillary service revenues in key markets. There was also a notable trend for solar-plus-storage projects providing semi-dispatchable renewable capacity.

“In terms of residential storage, state incentives, reduction in solar export tariffs and the need for backup facilitated storage deployment. Due to rapid system cost reductions, we expect sustainable growth to continue in markets where subsidies are being curtailed. With or without a subsidy, consumers are willing to pay a premium to increase their use of rooftop solar power and, in the process, mitigate the risk of electricity bill increases.

“The non-residential segment overtook the residential segment for the first time helped by subsidy and growth in South Korea. However it continues to be the most complicated proposition in several markets where it will take more time to de-risk, attract financing and become scalable,” added Le Xu, Wood Mackenzie Power & Renewables Senior Research Analyst.

Key storage markets to flourish

Between 2019 and 2024, Wood Mackenzie Power & Renewables expects major storage markets to thrive - with a more mature, but still early stage, GWh CAGR of 38%. Additionally, deployment numbers are expected to boom to 63GW/158GWh.

The U.S. and China are projected to dominate the market, making up 54% of GWh deployed capacity by 2024. This will be driven by market reforms, state mandates and, most importantly, the most significant energy sector transformation since the Dash for Gas.

FTM will retain its position as the largest storage segment through 2024. Storage will move from short-duration systems providing high value power services that are limited sized value pots, such as frequency regulation, into the realm of long-duration systems. At this point, FTM will displace diesel, oil and gas peakers, particularly in fuel import countries where conventional plant run costs are higher.

“We expect renewables-plus projects to become a popular trend through 2024. This is especially true for solar-plus-storage projects, as the requirement for clean and dispatchable renewables is widely accepted.

“In investment terms, we estimate the cumulative global energy storage market – defined, in this context, as total system capital expenditure on electrochemical and electromechanical energy storage systems, excluding pumped hydro – to grow six-fold to a total of $71 billion by 2024. $14 billion of that total will be invested in 2024 alone.

“The electrification epoch will unfold more rapidly over the next 5 years. With it, energy storage will become a necessary technology to enhance system flexibility and enable clean, rapid system balancing, while de-risking ever increasing intermittent assets and portfolios,” said Rory McCarthy, Wood Mackenzie Power & Renewable Senior Research Analyst.